startup company equity structure|Startup Equity : Cebu Understanding equity for your startup. <- Back to All Articles. If you’ve spent any time in the world of tech startups, you understand that equity typically plays a major role in total . How popular is Fely's tailoring and Dress Shop in Tuguegarao City - View reviews, ratings, location maps, contact details. PHILIPPINES. Home; Explore Top Locations; Explore Top Categories; Explore NearBy. Fely's tailoring and Dress Shop - .เว็บตรง ที่มั่นคง ปลอดภัย ครบจบในที่เดียว เว็บ kinggame365.com มีให้บริการทั้ง คาสิโน และ สล็อต มากมายที่ทำให้ผู้เล่นได้เข้าถึงอารมณ์คาสิโนอย่างแท้จริง เสมือนเข้าไปนั่งเดิมพันในคาสิโนที่ยิ่งใหญ่ ที่มีน้อง ๆ คอยบริการอย่างใกล้ชิดเลยทีเดียว เพราะ king game365 ใส่ใจทุกขั้นตอนตั้งแต่ ผุ้เล่นเลือกที่จะสมัครกับทางเว็บของ kinggame 365 .

PH0 · Understanding equity for your startup

PH1 · Startup Equity Split: How to Distribute Equity the Right

PH2 · Startup Equity 101: Navigating Distribution & Ownership

PH3 · Startup Equity 101: A Beginner's Guide

PH4 · Startup Equity

PH5 · Managing Startup Equity

PH6 · How to Distribute Equity for Your Startup

PH7 · How Startup Equity Works: A Comprehensive Guide

PH8 · How Startup Equity Works

PH9 · A Founder’s Ultimate Guide to Startup Equity

Colabore gratuitamente com versões online de Microsoft, Word, OneNote, Excel e PowerPoint. Salve documentos, planilhas e apresentações online no OneDrive. Compartilhe-os com outras pessoas para trabalharem juntos ao mesmo tempo.

startup company equity structure*******Startup founders have a handful of directions they can take to divide their startup's equity. We'll explain the most popular approaches toward dividing ownership .Understanding equity for your startup. <- Back to All Articles. If you’ve spent any time in the world of tech startups, you understand that equity typically plays a major role in total . Startup equity represents not just a share of ownership but a stake in potential success, making it a key factor in the startup ecosystem. This guide aims to demystify the . You’ve taken on plenty of challenges as you've grown your business — distributing startup equity is just another one to figure out. So to help you with the process, we'll review what startup equity is, see how it .Startup equity split among co-founders can be a defining step for your business and is essential to creating long-term relationships. When splitting equity, some of the factors to take into account include the risk involved from each side and . Equity in startup can refer to the company’s value after all debts are settled and assets are sold. It can also denote a person’s percentage of ownership in a company or asset. .

The basics of startup equity. Equity in a startup symbolizes not only ownership stakes but also the dedication of its contributors, encapsulated through shares that tether them .startup company equity structure Creating a Cap Table. Purchasing Founder Shares. Allocating Equity. The first task in distributing equity in a startup is allocating your startup equity. There are a number of .

Phase One - Startup Equity - Avoiding Early Mistakes. Phase Two - How Startup Equity Works. Phase Three - How to Split Equity. Phase Four - Part 1 - Equity Management ( ←YOU ARE HERE 😀) Part 2 - Recovering .An equity structure is an agreement between the shareholders of a company, setting down the investors’ rights and obligations in respect of the company’s profits and assets. Equity structures outline the way in which a company’s profits are divided amongst the shareholders and how the assets are utilised. The equity structure also defines .

This works more like a company bonus structure, whereby if the company hits certain milestones (typically a sale) the team gets a percentage of the proceeds. Let's start with Regular Equity Ownership. Similar to startup investing, there are pros and cons to how startups approach giving and getting equity.

This concept is vital for founders (founders own equity), as it aids in attracting talent and aligns with the typical startup equity structure and aligns team interests with company goals. Startups often offer stock options, Restricted Stock Units (RSUs), and .

startup company equity structure Startup Equity There’s no single best choice in terms of the type of company entity you choose, but there is a best choice for your company equity based on your goals. If you’re setting your business up as an equity play the structure that will facilitate stakeholders’ participation in stock sales while giving you the most flexibility and predictability .There’s a CEO premium. The role each founder plays is critical. “Generally the CEO gets more,” says Peter Pham, a serial entrepreneur, angel investor, startup advisor and cofounder of Science, an incubator in Santa Monica, California that has given rise to Dollar Shave Club and Bird.Pham remembers a team that came in to Science thinking they’d split the company 50-50.

A startup is a company or organization in its early stages, typically characterized by high uncertainty and risk. A key component of a startup is its equity, which is the ownership stake that founders and investors have in the company. The equity . You may see equity called “shareholders’ equity” (public companies) or “owners’ equity” (private companies). In each case the definition is the same: Equity is the portion of ownership shareholders have in a company. Types of equity in the private markets vary according to the legal business structure of the entity offering it.When setting up or changing your tech startup’s capital structure, hire legal counsel experienced in setting up early-stage ventures and working on investment rounds. . Initial equity. The founders of a startup generally purchase shares at the time of incorporating the company at a nominal price per share, such as $0.0001 per share, paid in .Equity should be split equally (or near equally) because all the work is ahead of you. My advice for splitting equity is probably controversial, but it's what we have done for all of my startups, and what we almost always recommend at YC: equal (or close to equal) equity splits among co-founders. [1] These are the people you are going to war with.

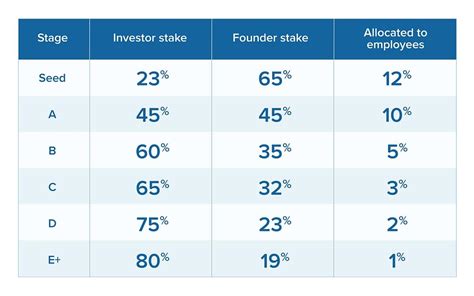

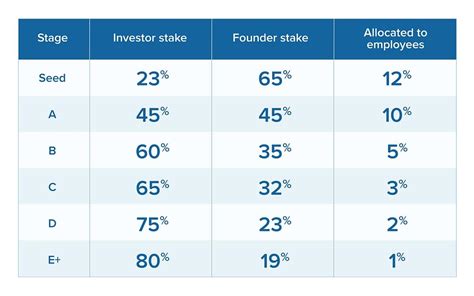

You can easily view the total shareholding of each founder and employee, and plan how you want to split your startup equity in the future.. Final Thoughts. Now that you have a fair idea of a typical startup equity structure, you will face fewer obstacles when splitting startup equity.Once again, as long as you provide everyone with a fair split while keeping your .

Startup equity refers to the ownership stake in a startup company. This can be distributed among founders, employees, and investors as a form of compensation, investment return, or initial ownership. Equity represents a share of the company’s future profits and value, giving holders a vested interest in the company’s success. Note: When determining your startup equity structure, we recommend consulting with your lawyer. Investopedia defines employee stock options as, “a type of equity compensation granted by companies to their employees and executives. . On the other hand, Michael Siebel, CEO of YC, offers a controversial take for splitting startup equity: equal . Below is the most common way to structure equity in a startup: Founders’ Equity: The ownership stake held by the startup founders. It often represents the initial investment of time, money, and intellectual property into the company. Employee Equity: Equity offered to employees, often in the form of stock options, RSUs, or other equity-based .

1. Issue shares of common stock. A simple method of offering equity in a startup company is to issue shares directly to employees. However, this is often an idealistic approach because it does not .

A startup's overall debt structure is the combination of debt and equity that the company uses to finance its operations. The most common financing structures for startups are venture debt, bridge loans, and convertible debt.. Venture debt is a type of debt that is typically used by early-stage companies.Venture debt is typically used to finance the company's .

A cap table, or capitalization table, is a spreadsheet that shows the ownership stakes in a company. It is important for startups to maintain an accurate cap table as they grow and raise capital from different sources because it helps track stock ownership, convertible securities, warrants and options, stock compensation grants to provide a fully-diluted picture of equity .

Three experienced startup founders narrow down six key factors to consider when deciding how much startup equity to give your first 10 employees. . Understand your business structure and its impacts. Companies that issue stock options are typically corporations (either C-corps or S-corps).Distributing startup equity can be a minefield for founders and entrepreneurs. Find out how to distribute it fairly with Brex. . So, for example, if you seek $1 million and offer 20% of your company's equity in return, an investment of $500,000 would buy a 10% stake.

CS.MONEY é o melhor site de skins de CS:GO/CS2. Aqui você pode trocar, comprar e vender skins de forma segura. Com nosso bot de trocas do CS:GO/CS2 você troca skins facilmente . Mostrar em Trade. Mostrar em Trade. Field-Tested. De. $ 28.90. Mostrar em Trade. Mostrar em Trade. Field-Tested. De. $ 39.10. Mostrar em Trade. Mostrar em .Mahjong or Mahjongg is fun and enormously popular, a classic Chinese game of strategy, skill, and summation. The classic version of the game uses 136 tiles and requires you to make identical sets and matching pairs from these tiles.

startup company equity structure|Startup Equity